The Meta-Yield Token turns a single deposit of ETH or UDSC into an auto-compounding position. Once minted, every MYT represents a growing claim on the underlying asset. No extra clicks are required to harvest or reinvest.

Prerequisites

- Connect your wallet and switch to the chain that holds the assets you plan to deposit.

- Confirm you have ETH for gas on that chain.

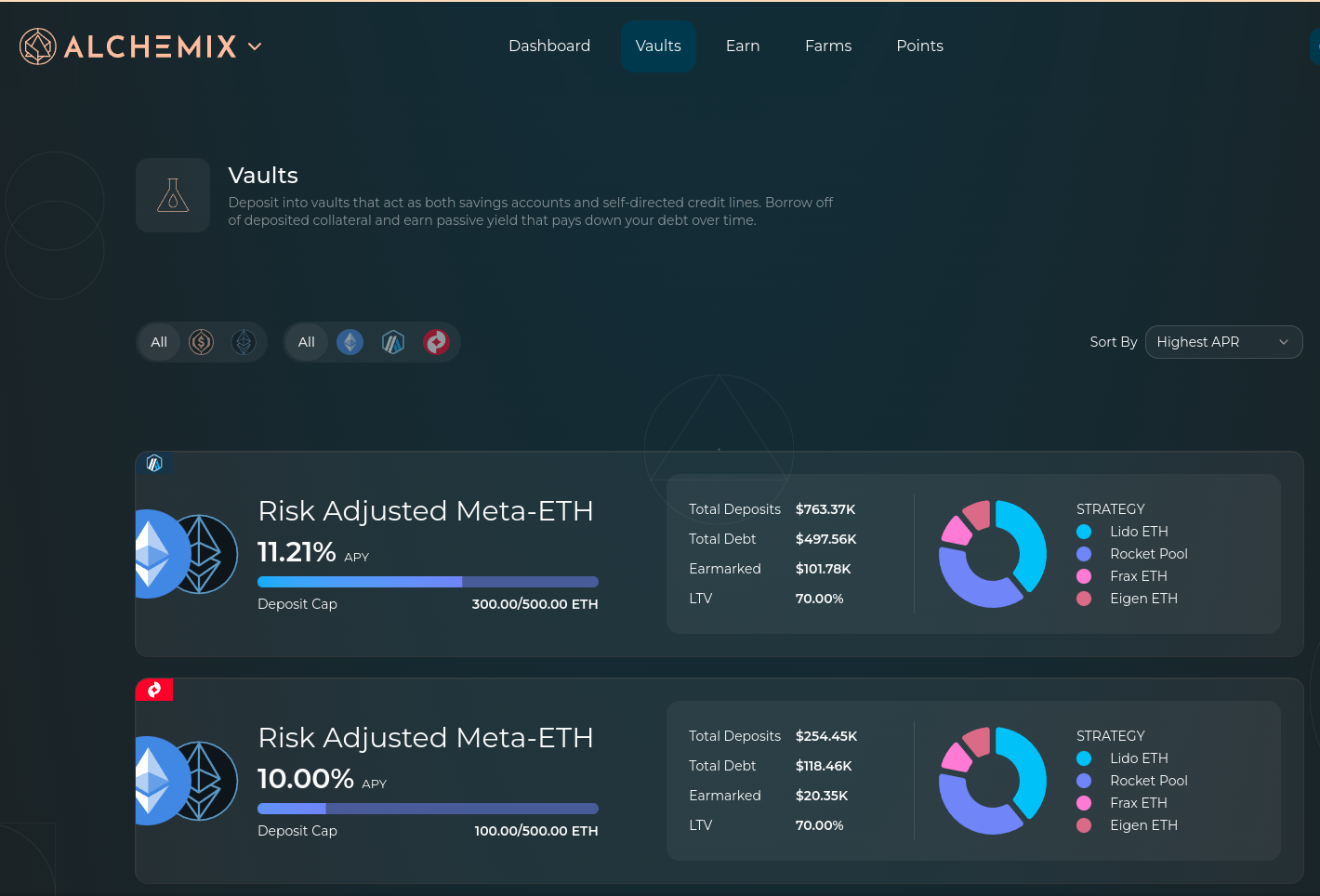

Step 1 – Open the Vaults page

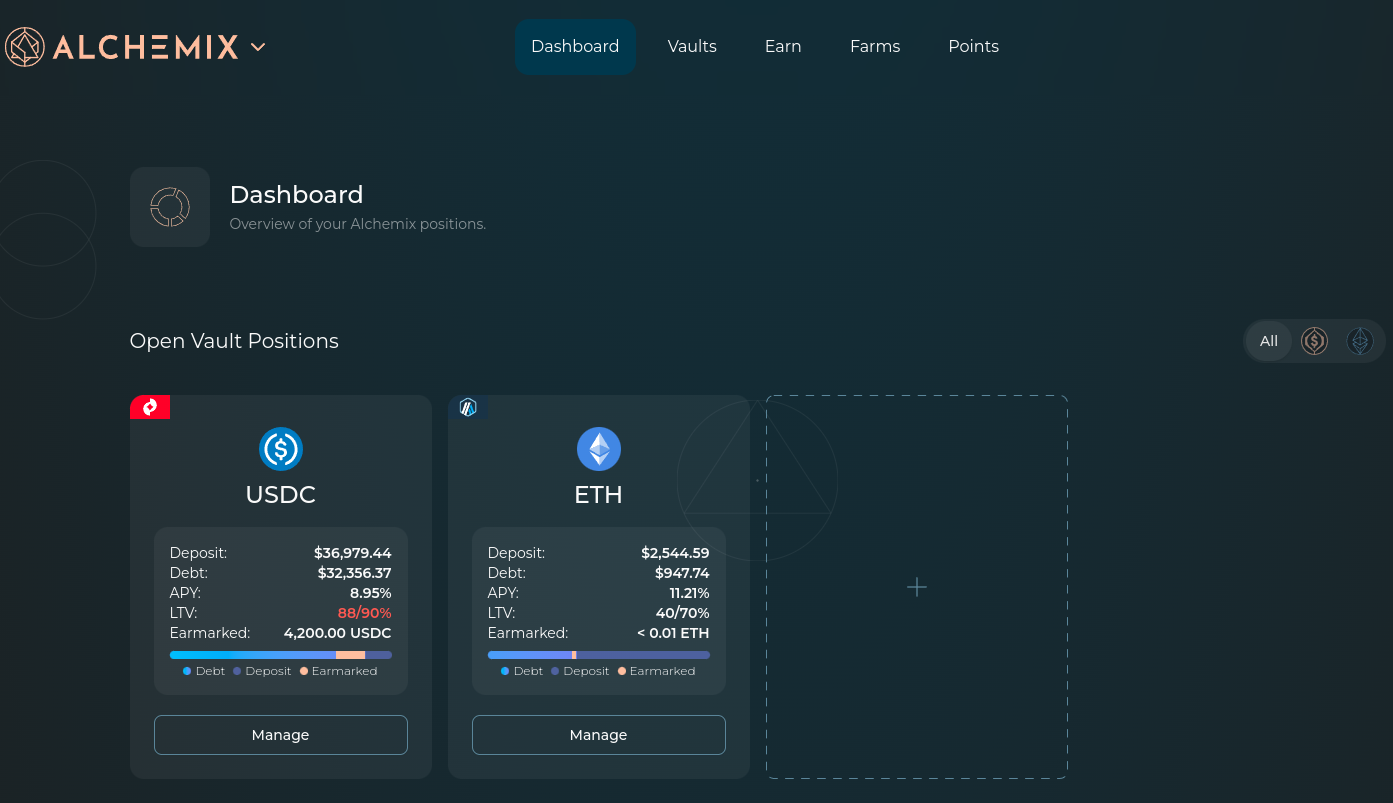

From any page choose Vaults in the top navigation, or click the empty tile with a plus sign on the Dashboard.

Step 2 – Select the MYT vault

Use the chain and asset filters to narrow down the list, then click on the vault card that matches your base asset.

Step 3 – Enter a deposit amount

The lower left panel opens on Deposit / Borrow.

Type the amount of ETH or USDC you want to deposit and leave the borrow field blank.

Step 4 – Confirm the transaction

Press Deposit. Your wallet will show the network, gas estimate, and the amount of MYT to be minted. Approve the transaction.

Step 5 – Track yield and strategy mix

Back on the Dashboard your new position appears as a vault position. Clicking into it will show a variety of information, including:

-

Vault balance – The dollar value of your current deposit, noted as “Deposit”.

-

APY – The current vault yield denominated in APY.

-

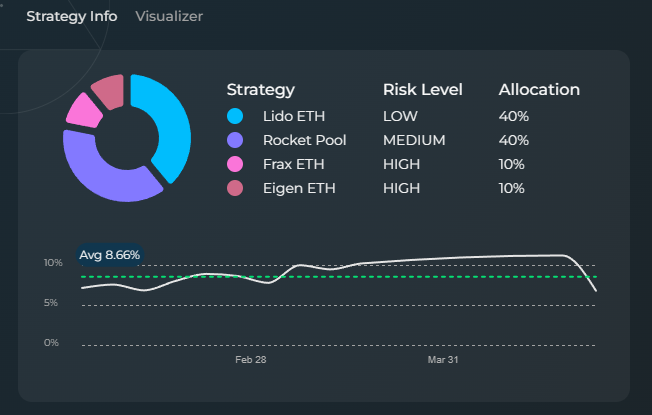

Strategy info – The current breakdown of strategies currently employed by the MYT basket, including a historical APY graph.

As yield accrues, the redemption value of each MYT increases automatically. You can withdraw at any time, the vault will return the underlying plus all earnings to date.

Why hold MYT instead of managing strategies yourself?

-

Diversified yield – Employ a wider variety of diversified strategies through one token, curated and rebalanced by the DAO.

-

Auto-compounding – Continuous compounding with no manual restaking.

-

Transparency – Transparent, on-chain view of strategy weights and historic performance.